-Takeaway #1: Regardless of which type of FIRE you might wish to choose, you get to customize your journey(how you get there) and your end destination( how much you ultimately save for).

You can live on a bare-bones budget enjoying free things like hiking a nature trail or checking out books/movies from your local library….if that’s the retirement lifestyle YOU want!

Or your goal could be to have a FIRE number that replaces your current earnings and covers your current expenses, freeing up your time to pursue a passion project like opening up a jewelry shop on Etsy…if that’s the retirement lifestyle YOU want!

Or maybe your preference is to have weekly brunch at the Four Seasons….and that’s the retirement lifestyle YOU want!

Your future retirement can and should be up to YOU!

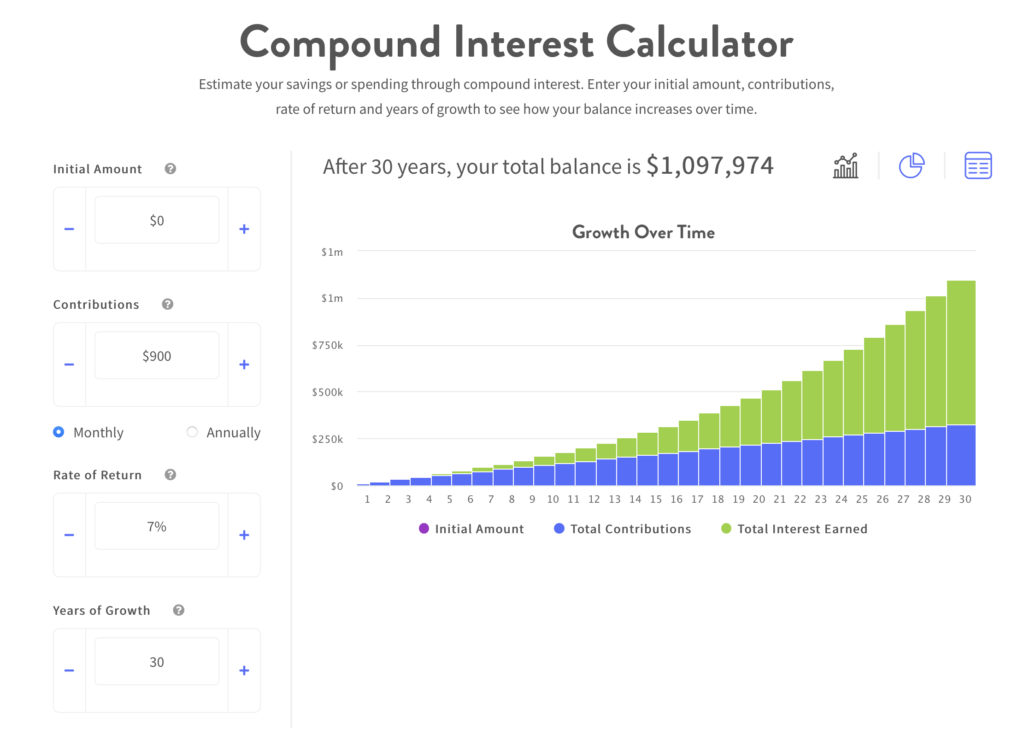

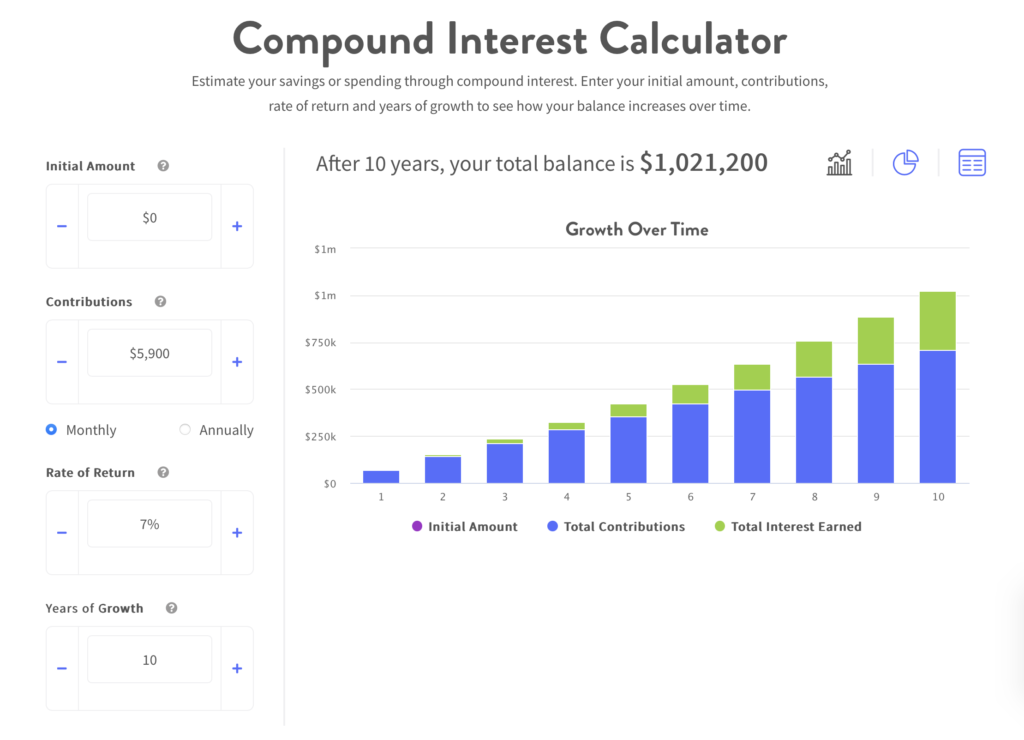

Just remember, at the end of the day, the math needs to “work”.

If you make comfort-based decisions today, it WILL affect your ability to reach your future goals.

So do some planning, really think about what YOU want and what you’re willing to sacrifice to get there.

Come up with your FI number and make an action plan to get there. As Paula Pant so wisely states, “You can afford anything…but not everything”.

-Takeaway #2: Reaching your goals certainly won’t be easy, but it WILL BE worth it!

Listen, I’m not here to sugarcoat it. Reaching your FI/FIRE goal will require hard work and determination.

You don’t have to live a destitute lifestyle but you WILL need to live with intention.

If it was EASY everyone would be doing it.

So consider pursuing the freedom to spend your time how you want.

The freedom that comes from not being anxious and fearful of how you’ll pay for whatever tomorrow brings.

The freedom afforded to the one whose finances are in order.

So come friend, and join me on this journey.

Let’s make the intentional choice, to not take the easy road, but the one worthwhile.

*** With a quick search on the internet you may find other “types of FIRE” mentioned. I simply chose to cover three of the most commonly referenced. Feel free to do your due diligence and see if there’s any other type of FIRE that might interest you!

Are you interested in reaching or already pursuing FIRE? Drop me a comment below, I’d love to hear how far along you are on your journey!